S P E C I A L : S O F T W A R E interview 4 1

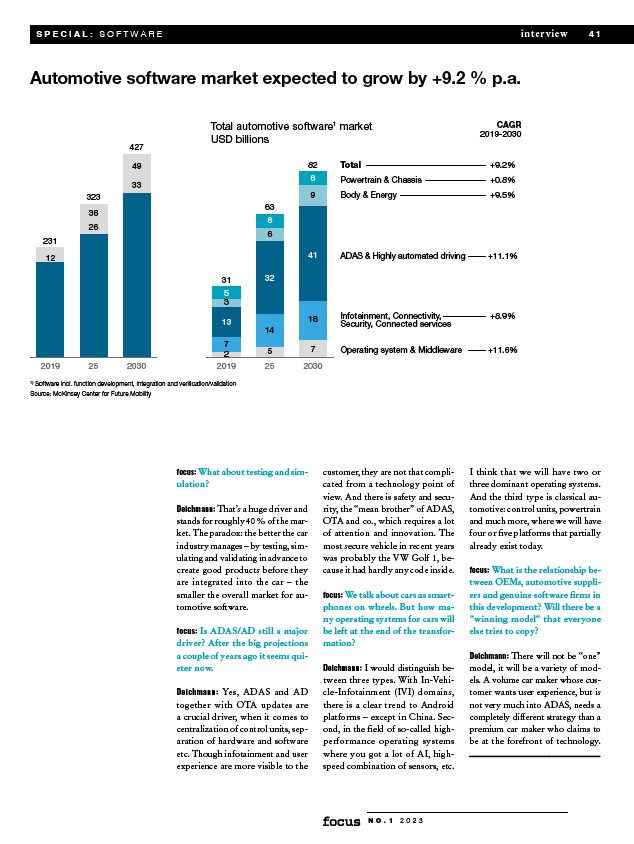

Automotive software market expected to grow by +9.2 % p.a.

CAGR

2019-2030

N O . 1 2 0 2 3

31

6

6

32

3 5

focus: What about testing and simulation?

6

9

41

18

Deichmann: That’s a huge driver and

stands for roughly 40 % of the market.

The paradox: the better the car

industry manages – by testing, simulating

and validating in advance to

create good products before they

are integrated into the car – the

smaller the overall market for automotive

software.

focus: Is ADAS/AD still a major

driver? After the big projections

a couple of years ago it seems quieter

now.

Deichmann: Yes, ADAS and AD

together with OTA updates are

a crucial driver, when it comes to

centralization of control units, separation

of hardware and software

etc. Though infotainment and user

experience are more visible to the

customer, they are not that complicated

from a technology point of

view. And there is safety and security,

the “mean brother” of ADAS,

OTA and co., which requires a lot

of attention and innovation. The

most secure vehicle in recent years

was probably the VW Golf 1, because

it had hardly any code inside.

focus: We talk about cars as smartphones

on wheels. But how many

operating systems for cars will

be left at the end of the transformation?

Deichmann: I would distinguish between

three types. With In-Vehicle

Infotainment (IVI) domains,

there is a clear trend to Android

platforms – except in China. Second,

in the field of so-called highperformance

operating systems

where you got a lot of AI, highspeed

combination of sensors, etc.

I think that we will have two or

three dominant operating systems.

And the third type is classical automotive:

control units, powertrain

and much more, where we will have

four or five platforms that partially

already exist today.

focus: What is the relationship between

OEMs, automotive suppliers

and genuine software firms in

this development? Will there be a

“winning model“ that everyone

else tries to copy?

Deichmann: There will not be “one”

model, it will be a variety of models.

A volume car maker whose customer

wants user experience, but is

not very much into ADAS, needs a

completely different strategy than a

premium car maker who claims to

be at the forefront of technology.

�

Total automotive software1 market

USD billions

Total ——————————————— +9.2%

Powertrain & Chassis ———————— +0.8%

Body & Energy ——————————— +9.5%

ADAS & Highly automated driving——— +11.1%

Operating system & Middleware ——— +11.6%

323

427

12

38

26

49

33

1) Software incl. function development, integration and verification/validation

Source: McKinsey Center for Future Mobility

Infotainment, Connectivity,—————— +8.9%

Security, Connected services

231

2019 25 2030

2019

63

82

2 7

14

5 7

13

25 2030